THE SMART QUANT

Financial Quant

Workbench

Workbench

| Quick and Efficient Valuation Solution |

|

| The Smart Quant (SSQ) is a valuation solution that allows all users to quickly and efficiently calculate fair value and risk indicators of OTC derivatives and structured instruments. For expert Quants, the SSQ is a tool that allows for accurate, real-time valuation and comparison analyses with other valuations and actual trades. Non-experts are also able to achieve the same results as a professional Quant at minimal cost. The SSQ is also a financial product factory that provides analytical support for the design of new structured products. |

Key Features |

|||

1 |

Comprehensive Product Coverage The SSQ processes all products from bonds to OTC derivatives of stocks, interest rates, foreign exchange, as well as commodities, credit, hybrid and index-based structured assets. Furthermore, it covers new structures from the securitization of the assets, including ELS, ELD, ELF, DLS, etc. |

3 |

Pricing Process Transparency The SSQ guarantees valuation accuracy and allows even non-experts to examine the steps of its valuation process, as well as run valuations from multiple angles. The valuation results also present for the user all required data for trade and risk management, including fair value, risk indicators, product design details, expected cash flow, scenario analysis, etc. |

2 |

Market-proven Models Not only does SSQ run market-proven and universally accepted valuation models, they are continuously improved by the FN Pricing Inc. and MIT Corporation Quant teams. Our teams enhance these models by applying actual market data and evaluation parameters to ensure that they accurately apply to all, diverse structured assets. |

4 |

Simple Solution for All Industries The SSQ is an ideal tool for product design, selling, investing and management, for all financial companies and non-financial industry groups. Namely, new product designers, analysts, traders, dealers, fund managers and high-risk, high-return private investors benefit from our software solutions. |

| Simple

Solution for All Industries |

The SSQ is an ideal tool for product design, selling,

investing and management, for all financial companies and non-financial industry

groups. Namely, new product designers, analysts, traders, dealers, fund managers

and high-risk, high-return private investors benefit from our software solutions.

|

Asset Managers |

|

Commercial Banks |

|

Investment Banks |

|

Private Banks |

|

Insurance Companies |

|

Industry |

|

Investors |

|

| Up-to-Date

Technology |

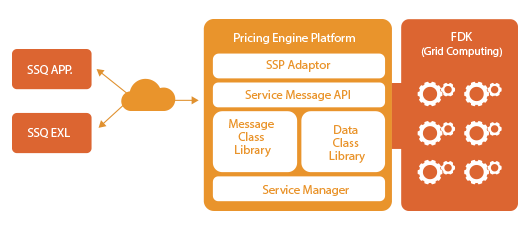

The SSQ synthesizes modern financial and mathematical

theories, software engineering and technical expertise to provide valuation

solutions for the most diverse and complex financial assets. - Grid processing on multiple computers, supporting Monte Carlo simulations, Lattice Model and other complex mathematical functions at optimal speed - Automatic term sheet generation - Automatic pay-off graph generation - API on Linux, Unix, Windows-based C, C++, C#, Java - Engine plug-in compatible with user-built pricing engines - UI/UX based on RIA (Rich Internet Application)

|

| Two-way Services |

The SSQ is available to users through an in-house installation of

the Symphony Product Control (SPC) as well as by Application Service Providing (ASP). Whether ASP or in-house, the SSQ provides services by product type, including Fixed Income, Equity, FX, Commodity, Hybrids, and Credit. |

1 |

ASP By allowing access to services of FN Pricing via terminal, the user is provided with valuation logic based on comprehensive market data, at minimal cost. Furthermore, the service is continuously enhanced with the automatic introduction of new products and expansion of functions. |

2 |

In-House In-house service installs the SSQ onto the client's system and fully integrated for user efficiency. The in-house version may also be customized to the needs of users. |